Artificial Intelligence (AI) is one of the most discussed technologies today. Initially, it did not gain so much attention due to the limitations it had. But now, it has evolved and transformed itself with sets of potential features that disrupted many industries. The potentials of AI have taken many industries by surprise, and they are exploring the possible way to incorporate the AI system into their business.

Banking and Finance are the one among many industries, which are going to be the most beneficial sector in the next couple of years.

How AI Transforming Banking & Finance

AI has vivid scope for consumer-centric industries, bringing them artificial intelligence-based solutions for many consumer-facing problems. In banking and finance, it can be proved to be boon.

In fact, according to stats, it is estimated that by 2030, the banking sector will save over $1 trillion while the financial sectors can get a record of 22% in total operating expense reduction.

Banking and finance, especially those having a large customer base, can solve many traditional banking problems using Artificial Intelligence. So, I am here with some fruitful tips explaining how you can come over the huge customer success burden by implementing the AI into the system.

Chatbots and Personalized Customer Service

Chat is more significant than social networks, and people use chat application for not just to chat with friends but also the outer world. They use chat applications to book tickets, order food online, connect with brands, browse products and get banking services on the fingertip. With the evolution of AI, chats have become the center of attracting users at large. Banking is one of the largest beneficiaries of AI chatbots.

AI enabled chatbots to make banking services accessible to a large number of customers, and most of the facilities can be accessed through Chatbot directly. AI gives personalized experience to your customers; increases client satisfaction; improve efficiency; maintain customer loyalty and to name just a few.

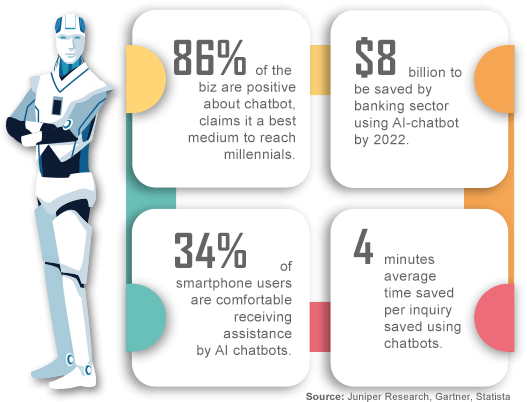

Here are some important data of AI-Chatbots

- 86% of the biz are positive about chatbot, claims it a best medium to reach millennials.

- $8 billion</strong > to be saved by banking sector using AI-chatbot by 2022.

- 34% of smartphone users are comfortable receiving assistance by AI chatbots.

- 4 minutes average time per inquiry, saved using chatbots.

Source: Juniper Research, Gartner, Statista

Here are some of the most important things that chatbot can do to enhance banking efficiency and provide better satisfaction to clients.

24/7 Banking Services

People hardly have time (due to work or tight schedules) to pay a visit to banks. They were looking for alternate solutions that could help enjoy all banking services right from anywhere, anytime. Chatbot came offering the same. All banking services such as a complaint, account opening request, balance inquiry, asking for details, etc. have become handy and all customers to use the services remotely. AI enabled Banking and Finance IT Solutions makes sectors remain connected to their potential clients. At the same time, it allows banks to provide personalized support to clients. That means most of the services are available to clients 24/7.

Let’s take some examples of such chatbot developed by banks.

Amy

It’s entirely AI-integrated chatbots developed for corporate banking customer support. Amy developed by HSBC bank based in Hong Kong and covers plenty of services that directly connect the chatbot to the users. Amy can speak Chinese and English and provide comprehensive answers to all questions of its capacity.

Erica

Bank of America introduced Erica – an integrated AI program to carry out some general tasks such as sending notifications, helping customer know their bank balance, improve the customer with a suggestion to save money, pay bills and much more.

Coin

The chatbot Coin developed by JPMorgan, one of the largest bank in America, to monitor office operations. The chatbot helps the bank in analyzing complex contract quickly, finding sources of income and decrease expenses. The bank claims that it has saved 360,000 hours each year.

Similarly, plenty of such banks are there which are saving some quality bucks and earning profits using AI chatbots.

Personalized Support

AI-enabled chatbots can provide customized support to your potential clients. Chatbot goes through clients’ past records and based on the record it understands the client’s behavior and acts accordingly.

According to the Gartner, almost 85% of banks will take help of AI-chatbots to enhance customer engagement.

Chatbot simply makes customer interactions easy by making them available to the desired services and products. That increases retention rate and attract new clients, apart from huge cost saving.

AI Chatbot for Personal Banking Service

Expectations of customers are never-ending demand that is going to be with you forever. Your consumer would like to get all personal banking services such as managing their accounts, helping them in transactions and much more within a second.

Excellent Customer Support Service

The delay in services is most concern issue for banks and finance sectors. Providing instant support to the customer was a great concern for most banks and finance industries –thanks to the AI-enabled chatbot that solve this problem. Initially, chatbots were there, but they were either not AI-integrated or was narrow AI -such chatbots had many limitations. But, the advanced AI-integrated chatbots can do everything just like a human can.

90% of customers say that they are not happy with the services offered by most banks.

It can talk to your customers, understand their behavior and reply to all relevant questions promptly. The chatbot can recognize when it helped the particular customer last time and remind them if needed. Quick services with attachment are the best thing that you can offer to your customers with the help of traditional chatbots.

Employee Assistance

AI-chatbots help not only your customers but also your employees by enhancing their skills and productivity. Chatbots provide training to work efficiently, teaching them to work with complicated banking software, memorizing them security rules & policies and much more.

HR Support

HR of the company has to manage plenty of things and take all employees along. That’s the most complex task, and AI can simplify this by help HR keeping the data in order and extracting useful information from request data.

How AI Helps in Real-Time Fraud Detection & Security

Gone were the days when frauds in banking were limited to loan defaults and robbery only. But as technology advanced, people started getting a plenty easy way to interact and transact with their banks, it gave rise to many frauds, and that is why security has been the main concern for banks.

Types of Frauds BFSI Sector dealing with: In an online term, online banking itself is vulnerable to frauds and hack. So, anything can happen. Generally, there are five main and most common types of banking fraud. They include;

- Money laundering

- Internal fraud

- Credit card fraud

- Mobile fraud

- Identity and social fraud

Here’re some of the top banking frauds happened over the years.

- Hackers robbed $81 million from a bank based in Bangladesh in 2016.

- £650 million online frauds came into light in 2015 when many financial institutions across the world reported hacking.

- Online cybercrime has caused massive loss to the global economy with $600 billion yearly which accounts for 0.8% to the global gross domestic product. Reports McAfee

Similarly, many such incidents you can find and you will see the case of fraud has risen ever since online banking system evolved.

Let’s understand how AI helps banking and finance industry eliminates fraudulence.

Avoiding Fraud, a Rising Challenge for Banks

Avoiding fraud including money laundering has been a challenge for the banking and finance industries. They were looking for efficient solutions for it. Thankfully, AI has all the potentials to prevent frauds of all types. The technology (AI) has evolved powerful and can help Banking and Finance eliminate any uninvited situation much in advance.

Detects Possible Future Fraud

When you integrate AI tool in the system, it can identify if something might cause deception in the near future. There are many tools which are developed by AI which compresses data and let you analyze the potential threats in advance. AI, simply, ensures that everything (the deal you are making) is safe. AI integration can help you prevent all such frauds and vulnerability; here’s how.

Gives Complete Analysis of Customer

If you are offering loan to any customer, you can take help of the AI tool provides a complete analysis of customer that include full details of his/her past financial records and spending behaviors. One such example is it can tell you if a transaction from the same card has been done twice at a different location in just a few hours of the gap. Getting through his/her past records, transaction history, etc., you can quickly analyze things that help you take steps into the right directions. Interestingly, it cannot be manipulated that too, naturally. It is not like red alert which can be improved by bringing changes in software rather AI simply does this by learning from the experience.

Identity Theft

Artificial Intelligence ensures to keep your identity such as online banking ID and password safe from hackers. Integration of biometric identification that includes voice and facial recognition can help enjoy secure baking services.

Fraudulent Transaction

Banks never know the behavioral pattern of the transaction and keeping an eye over frauds, the bank can integrate AI with Machine Learning to understand your regular transaction pattern. AI with ML will develop a system that would raise the alarm if any irregular activity which not matching with your regular transaction pattern.

Offers Robust Security:

New technology often comes up with a new set of issues and circumstances whether it is customers’ data or the highly sensitive details of your bank and finance company, the data has to be protected at all cost. Apart from that, losing customers’ private data comes under industry regulations, and you need to protect by all means.

AI is the single robust solutions that ensure that your customers’ data is protected. It provides multi-layer of security which will reduce the risk data breach. AI, paired with Blockchain technology will provide robust security solutions which will reduce the risk of tampering with data or transactions.

Role of AI as Financial Advisor

An AI can work as your financial advisor and help you with the right investment advice. Financial industries have a hell of a lot of pressures to reduce commission that it charges when people come for investment.

AI Bot as an Advisor:

An AI-enabled robot can turn into a financial advisor and help people in such a way that even humans don’t. It efficiently advises clients the right way to invest and what should be followed to get more benefits in the future. AI-robot-turns-financial advisor goes through every single detail of customers, analyze his goals and suggest stocks and bond based on the analytical report.

In other terms, AI Robot can work breakthrough and provide users personalized solutions quickly. For example, it can tell which one of your customers can get maximum profit by refinancing her/his mortgage. You can even ask AI robot to let your client know about this, and it will create an email for you quickly. These are significant benefits you get from your AI robot.

Cognition and Data Extraction:

Your financial advisor does many things for you and data extraction is one of the most significant tasks that it carries out on your behalf. It will help you with wealth management. Cognition is something that makes the machine learn from human and work accordingly. Financial data extraction is such an example of AI technology.

AI Robot Simplifies Dark Data:

Dark data refers to the thing that is new, and we don’t know anything about. The robot can tell you everything in details regarding how the market will behave and how the investment will be made in the future. AI does this by analyzing human behavior and understanding their investment pattern. So, no needs to wait until you go through the entire data. Take advice from your intelligent AI advisor and get the best solutions on the right in place.

AI in Trading:

AI is the most skilled and intelligent financial brain that the industries were looking for a long time. Perfect prediction is the player for the trading market. Investment companies are more relying on computers and data scientists to predicts and find the scope of investment. But, things changed with the evolvement of Artificial Intelligence. Not only, AI robot obeys your commands, it also learns things, and that helps the machine provide wise advice.

Attributes of AI:

As it can go through millions of data and come up with accurate predictions that no one can do, you can rely upon the technology and get the best marketing solutions. It does not only scan through the data, rather, it understands the pattern in past data and analyzes how this pattern may reoccur or act in the future. In simple term, it can help investor getting investment solutions and marketers with great predictions.

How AI helps in Managing Finance

AI-based wallet developed through PFM (personal financial management) solutions that help users to take a smart decision by analyzing all algorithms. In simple term, it analyzes thing after gathering data from your web footprints and brings you refined spending graphs.

It saves time in making a lengthy spreadsheet and writes down a long note on a piece of paper. Whether it personal, small-scale investment to a large scale investment, AI is just a must-have tool for everyone.

AI Helps Bank & Finance Industry Improve Services and Products

Artificial Intelligence (AI) creates insight reports, detailing all the services and products and how customers interact with those services. Importantly, when you understand your customer requirement, you get a chance to improve and provide your customer with enhanced solutions. The insight prepared by AI-tool gives you complete details of your customers’ behavior and requirements.

When you talk to a customer or take any initiative, you have detailed reports and based on the stories you get a comprehensive idea of how to deal with different customers. In case, one of your customer and that’s the winning point you get with the support of AI.

How Artificial Intelligence helps in Process Automation

Robotic Process Automation is on the rise ever since AI evolution got in place. AI with RPA offers fantastic support to the banking and finance industries to automate the process using the intelligent systems.

Case Study of JPMorgan

JPMorgan Bank is one of the live examples of taking AI help to automate the system. It has developed COiN which works to review the document and extract data from the docs. For instance, if someone applies for a loan, there is no human being to receive the application, rather it is the robot which extracts all required data from the application and takes it to the further process. If it has any problem or needed additional information from the customer side, then it will send the application back to the customers asking to attach the necessary file.

JPMorgan Bank claims that it saves around 360,000 hours every year using COiN -Chatbot. That’s a considerable saving, no doubt.

Business process automation in banking and finance is the key drivers, and you get robust solutions when you integrate AI in the process automation system. It turns your automation into cognitive process automation and can perform excellently even complex automation.

For example, the marketing automation process powered by AI will extract the vital information from documents such as loan application, lease agreement, account opening application, etc. submitted by consumers.

Looking for Secure & Reliable

Fintech Solutions?

Conclusion

The bottom line of the content is that the AI is evolving and offering more enhanced business solutions. If you have a large customer base, you should consider implementing the AI to stay on the top. AI integrated web, and mobile application is about to be need of the hour. You need to prepare yourself now. More than that, you need to get more specific; think about the usefulness of the applications based the consumer traffic and how the initiative will benefit them. Ultimately, AI integration is all offering ease of accessing services.

Say

Say