Quick Summary:

Are you an insurance professional looking to optimize underwriting efficiency? Our blog on AI insurance underwriting is for underwriters, executives, and tech decision-makers facing lengthy risk assessments and high error rates. Discover how AI automates risk assessments, reduces errors, and provides deeper insights. If you want to stay competitive, this blog is a must-read.

In this blog, we’re going to discuss📝

- The Rise of AI in the Insurance Industry

- AI Insurance Underwriting: Purpose and Overview

- How AI is Transforming Insurance?

- AI in Insurance Industry: Use Cases

- Generative AI and Modern Underwriting Solutions

- Benefits of AI Underwriting

- Challenges of AI in Underwriting

- The Future of AI in Underwriting

The insurance industry is undergoing a major transformation with the rise of artificial intelligence (AI). AI underwriting has emerged as a powerful solution to streamline the traditionally complex process of risk assessment. By combining automation, machine learning, and big data analysis, insurers are now able to make faster, smarter, and more accurate underwriting decisions.

From processing applications to analyzing massive volumes of data, AI is reshaping the insurance sector. Whether it’s life insurance, property, mortgage, or commercial underwriting, AI tools are making risk predictions more efficient and reliable. In today’s fast-paced insurance environment, companies embracing AI underwriting are gaining a competitive edge while offering better services to their customers.

The Rise of AI in the Insurance Industry: Stats, Studies, and Surveys

The adoption of AI in the insurance industry has been exponential over the last decade. Companies are investing heavily in advanced underwriting technologies to improve efficiency and accuracy. Recent industry studies and surveys reveal just how impactful AI has been:

- As per a study published on Allied Market Research, the global AI in Insurance market size was valued at $2.74 billion in 2021 and is projected to grow to $45.74 billion by 2031.

- As per the findings of a Deloitte Center for Finance Services Survey, the most used spaces for Gen AI implementations were distribution, risk management and claims handling.

These figures illustrate why AI is not just a buzzword but a critical driver of innovation in the insurance landscape. Companies that invest in AI tools are seeing tangible results, such as faster decision-making, reduced operational costs, and improved accuracy in risk evaluation.

AI Insurance Underwriting: Purpose and Overview

AI underwriting represents a transformative shift in the insurance industry, leveraging artificial intelligence, machine learning, and advanced data analysis to revolutionize how insurers evaluate risk and process applications.

This modern approach offers significant improvements in efficiency, accuracy, and customer satisfaction, paving the way for a more streamlined and responsive insurance experience.

What is AI underwriting?

AI underwriting uses artificial intelligence, machine learning, and data analysis to evaluate risk, process insurance applications, and determine policy eligibility more efficiently.

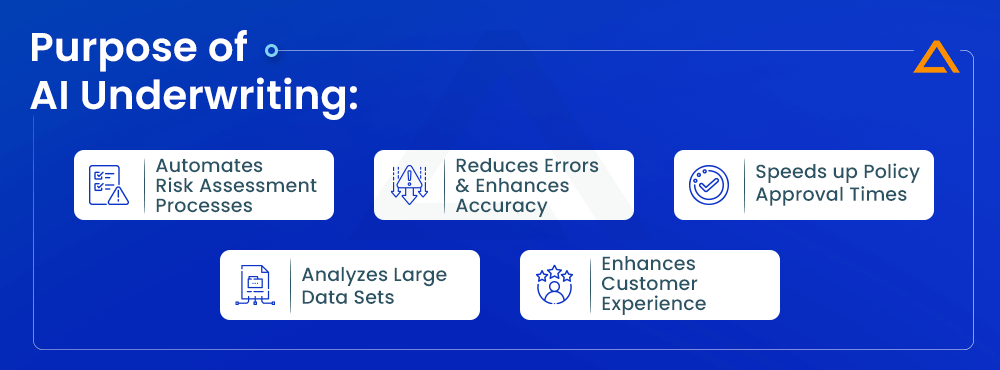

Purpose of AI underwriting:

- Automate manual risk assessment processes.

- Reduce human error and enhance accuracy.

- Minimize processing times for policy approvals.

- Analyze large data sets quickly to make better decisions.

- Improve customer experience through faster responses.

Why is AI Underwriting important?

AI underwriting bridges the gap between speed and accuracy. Traditional underwriting, while reliable, is time-consuming and often subjective. With AI, insurers can make data-driven decisions in minutes rather than days, benefiting both the company and the customer.

Key Solutions in AI underwriting:

- AI-powered underwriting software

- Generative AI models for data predictions

- Machine learning-based risk assessment solutions

By automating repetitive tasks and analyzing data at scale, AI is helping insurers improve operational efficiency and focus more on customer-centric services.

How AI is Transforming Insurance?

The use of AI is revolutionizing every aspect of the insurance industry, and underwriting is no exception. Traditional underwriting processes are labor-intensive and prone to inefficiencies. With AI, insurers are witnessing a paradigm shift in the following areas:

Automating Manual Tasks

AI tools can automate repetitive and time-consuming tasks, such as data entry, document verification, and risk scoring. This not only reduces human effort but also accelerates the underwriting process.

Improving Risk Assessment

Machine learning algorithms analyze massive datasets to identify patterns and predict risks accurately. For example, AI can evaluate medical records, credit histories, and property data to determine risk levels in seconds.

Enhancing Claims Processing

AI insurance claims simplify the process management by verifying claims, flagging fraudulent activities, and reducing processing times. Insurers can deliver faster payouts to customers without compromising accuracy.

Providing Better Customer Experience

Faster processing times mean customers no longer need to wait for weeks to get their policies approved. AI ensures quick responses, enhancing customer satisfaction.

Overall, AI-powered underwriting is transforming the insurance industry by combining automation with smarter decision-making.

AI in Insurance Industry: Use Cases as per Sub-Sectors

AI underwriting is not limited to one area of insurance. Here’s how it applies to various sub-sectors:

AI in Life Insurance Underwriting

Life insurance underwriting traditionally involves time-consuming processes such as analyzing mortality risks, reviewing medical histories, and assessing lifestyle factors like smoking or alcohol consumption.

AI is transforming this process by automating and enhancing risk evaluation, using deep learning algorithms to analyze a larger volume of data much more accurately than traditional methods. AI tools can evaluate medical records and lifestyle data in real-time, identifying critical risk factors like undiagnosed health conditions or hereditary diseases. This allows insurers to:

- Enhance accuracy: AI-powered risk models reduce human errors and biases by analyzing data in a way that uncovers hidden patterns in individuals’ health data.

- Speed up policy approvals: Automation of medical evaluations and data processing shortens the underwriting cycle, allowing insurers to approve policies much faster.

- Improve customer experience: With faster decisions and more accurate risk assessment, customers experience quicker service without compromising accuracy.

- Predictive health analytics: By using AI to analyze historical health data, insurers can anticipate future health issues and adjust their policies accordingly.

AI in Mortgage and Real Estate Underwriting

Mortgage and real estate underwriting are essential parts of the property acquisition process. Traditionally, these processes rely heavily on manual checks, such as assessing property values, checking credit scores, and evaluating borrower risk profiles. AI introduces automation and predictive analytics, significantly improving efficiency and accuracy in the decision-making process.

- Automating property assessments: AI models can automatically assess a property’s market value by considering historical sales data, neighborhood trends, and economic indicators, reducing the reliance on manual appraisers and the risk of human error.

- Risk prediction and credit scoring: AI-based algorithms evaluate the borrower’s creditworthiness by analyzing a wider array of data points, from credit history to social behaviors, helping reduce the chances of loan defaults.

- Real-time property risk analysis: AI tools help insurers predict property risks by analyzing weather patterns, geographical data, and past claim trends, allowing them to better forecast potential issues like flooding or earthquake damage.

- Enhanced fraud detection: AI can identify inconsistencies or red flags in applications, ensuring that fraudulent mortgage applications are flagged early in the process.

AI in Commercial Insurance Underwriting

Commercial insurance underwriting requires a deep understanding of the specific risks a business may face, such as operational risks, property hazards, and financial performance. AI-powered solutions are changing the landscape of commercial insurance underwriting by automating data collection and processing while providing more accurate and granular risk assessments.

- Industry-specific risk models: AI tools are designed to evaluate industry-specific risks, such as technological vulnerabilities for tech companies or environmental risks for manufacturing businesses, ensuring a more accurate and tailored underwriting process.

- Advanced predictive analytics: AI can predict potential claims by analyzing past claims history, the financial health of the business, and external market conditions. This allows insurers to offer more accurate and personalized pricing.

- Improved fraud detection: AI systems can detect fraudulent activities or inconsistencies in applications by cross-referencing large sets of business and financial data, improving the accuracy of risk evaluation and minimizing fraud.

- Personalized policy offerings: AI algorithms help insurers create customized policies for businesses based on their unique risk profiles, business size, and industry, increasing client satisfaction and policy effectiveness.

AI in Credit Underwriting

AI plays a crucial role in credit underwriting by automating the evaluation of borrowers’ creditworthiness. Traditional credit scoring models, which focus mainly on credit history and financial data, are enhanced by AI to incorporate a broader range of factors, leading to quicker approvals and more precise risk assessments.

- Real-time credit decisioning: AI allows financial institutions to approve loans almost instantly by evaluating a vast array of data points, including alternative credit scores and non-traditional financial behaviors, such as payment histories for rent or utilities.

- Predictive loan default risk: By using machine learning algorithms to predict a borrower’s likelihood of defaulting, AI models provide banks and lenders with better tools for managing credit risk and minimizing losses.

- Increased financial inclusion: AI enables lenders to approve loans for individuals with little to no formal credit history by using alternative data sources such as social media activity, mobile phone usage, and payment behaviors.

- Better fraud detection: AI tools can detect anomalies in loan applications, flagging potential fraudulent behavior early on and reducing the risk of financial loss.

AI in Property and Casualty (P&C) Underwriting

Property and casualty (P&C) insurance underwriting involves evaluating risks related to property ownership, vehicles, and other assets. AI is revolutionizing this space by making the underwriting process faster, more accurate, and more predictive.

- Risk assessment automation: AI can analyze vast datasets, including satellite imagery, weather patterns, and geographical data, to assess risks for properties more comprehensively than traditional methods.

- Accurate property valuations: AI tools can use historical claims data, property conditions, and other relevant information to provide more accurate property valuations, reducing the risk of over- or under-insuring assets.

- Enhanced claims processing: AI-powered chatbots and automated claims processing systems can speed up the entire claims lifecycle, from reporting to resolution, improving efficiency and customer satisfaction.

- Fraud prevention: AI models are trained to spot fraudulent claims by detecting unusual patterns and inconsistencies in the claims process, saving insurers from financial losses due to fraud.

Looking for BFSI IT Solutions?

Get fast-track BFSI digital transformation with secure, scalable solutions!

Generative AI and Modern Underwriting Solutions

Generative AI, a cutting-edge branch of artificial intelligence, is revolutionizing the insurance industry by enabling the creation of innovative solutions and new data insights. Unlike traditional AI models that analyze existing data to make predictions, generative AI solutions goes a step further by generating new data and insights, thus offering unprecedented capabilities for modern underwriting solutions.

Automated Underwriting Systems

Automated underwriting systems powered by generative AI are transforming how insurers assess risks and process applications. These systems streamline and enhance every step of the underwriting process, from data collection to decision-making.

- Data Collection and Integration: Automated systems efficiently gather data from various sources, including customer applications, medical records, credit reports, and social media profiles. Generative AI can synthesize this data, identifying patterns and correlations that may not be immediately apparent.

- Risk Assessment: By leveraging machine learning algorithms, these systems can evaluate risk factors more accurately. Generative AI models can simulate different scenarios and predict potential outcomes, allowing underwriters to make informed decisions quickly.

- Decision-Making: Generative AI enhances decision-making by providing real-time insights and recommendations. It can assess the likelihood of claims, predict future risk exposures, and suggest appropriate policy adjustments to mitigate risks.

Generative AI Models

Generative AI models represent the pinnacle of AI advancements in underwriting. These models use advanced neural networks to generate new data points, scenarios, and insights that traditional models cannot.

- Predictive Analytics: Generative AI models can predict future risks with high accuracy by analyzing historical data and generating new data points that reflect potential future trends. This capability allows insurers to anticipate and prepare for emerging risks.

- Pricing Strategies: By generating data on various risk scenarios, generative AI helps insurers develop more accurate and dynamic pricing strategies. This ensures that premiums are reflective of the true risk, leading to fairer pricing for customers and better risk management for insurers.

- Scenario Simulation: Generative AI can create multiple risk scenarios, enabling insurers to test the robustness of their underwriting strategies. This helps in identifying potential vulnerabilities and optimizing underwriting policies accordingly.

AI-Powered Underwriting Software

AI-powered underwriting software integrates machine learning and predictive analytics to enhance the efficiency and accuracy of the underwriting process.

- Enhanced Risk Models: AI-powered software uses sophisticated algorithms to continuously refine risk models based on new data. This ensures that risk assessments are always up-to-date and reflective of the latest information.

- Improved Efficiency: By automating repetitive tasks and providing real-time insights, AI-powered software significantly reduces the time required for underwriting. This leads to faster policy approvals and better resource allocation.

- Customer-Centric Solutions: AI-driven software can tailor underwriting processes to individual customers by analyzing their unique data profiles. This personalization enhances customer satisfaction and ensures that policies are well-suited to their needs.

Benefits of AI Underwriting

AI underwriting offers several advantages that are reshaping the insurance landscape:

- Faster Processing Times: Automating underwriting tasks significantly reduces policy approval times.

- Improved Accuracy: AI eliminates human errors and ensures risk evaluations are data-driven and objective.

- Cost Savings: Automation reduces operational costs and manual labor.

- Better Risk Predictions: AI tools analyze vast datasets to forecast risks more accurately.

- Enhanced Customer Experience: Customers benefit from faster responses and a seamless approval process.

These benefits not only improve efficiency but also help insurers stay competitive in an increasingly digital market.

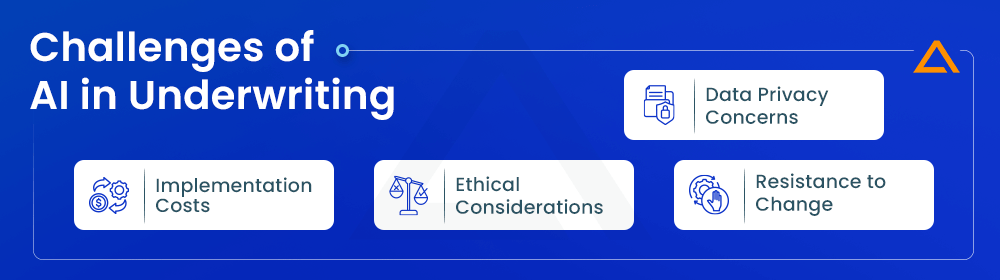

Challenges of AI in Underwriting

Despite its advantages, AI in underwriting comes with challenges:

- Data Privacy Concerns: Handling sensitive customer data raises concerns about privacy and security.

- Implementation Costs: Adopting AI tools requires significant upfront investment in technology and training.

- Ethical Considerations: AI algorithms must be transparent and unbiased to avoid unfair risk evaluations.

- Resistance to Change: Traditional insurers may hesitate to adopt AI due to fear of disrupting existing workflows.

To overcome these challenges, insurers need to focus on ethical AI practices, robust data protection, and proper implementation strategies.

The Future of AI in Underwriting

The future of AI underwriting looks promising, with continuous advancements in machine learning and automation. Key trends include:

- Increased Automation: More underwriting tasks will be fully automated, reducing human intervention.

- Improved Predictive Analytics: AI will leverage big data to predict risks more accurately and personalize policies.

- Enhanced Fraud Detection: AI tools will detect and prevent fraudulent claims with higher precision.

- AI in Emerging Markets: AI will play a critical role in expanding insurance coverage in underserved regions.

AI is set to revolutionize underwriting by making processes faster, smarter, and more customer-centric.

Wrapping Up

AI underwriting is transforming the insurance industry by automating tasks, improving accuracy, and enhancing customer experience. From life insurance to credit and real estate underwriting, AI is driving innovation across all sectors. While challenges like data privacy remain, the benefits far outweigh the hurdles, making AI underwriting a cornerstone of the future insurance landscape.

By adopting AI-driven tools and strategies, insurers can streamline their operations, make smarter decisions, and deliver exceptional value to their customers. The future is AI-powered, and underwriting is no exception.

Say

Say