Quick Summary:

AI in insurance is transforming the industry by improving underwriting, speeding up claims, and enhancing customer experiences. This blog explores how AI-driven solutions can tackle common challenges like data overload, fraud, and competition, offering practical insights for insurers seeking efficiency and growth.

Artificial Intelligence (AI) is revolutionizing the insurance industry by streamlining operations, enhancing customer experience, and introducing unprecedented levels of efficiency. Insurers are harnessing AI-driven tools to tackle challenges in underwriting, fraud detection, claims processing, and personalized services.

This blog explores the need for AI in the insurance industry, highlights emerging trends, and provides in-depth insights into its applications, beneficiaries, and overall impact.

The Need for AI in the Insurance Industry

The insurance industry generates massive volumes of data from claims, customer interactions, and risk evaluations. However, traditional methods of handling this data are time-consuming and prone to human error.

Why AI is Critical

- Rising Customer Expectations: 71% of insurance customers expect personalized interactions, yet most insurers struggle to deliver such experiences. (McKinsey)

- Fraudulent Activities: The US insurance industry loses approximately $80 billion annually due to fraud, making fraud detection a pressing need. (Science Direct)

- Data Overload: Manual data analysis is insufficient to process the increasing complexity of data from IoT devices, wearable tech, and telematics.

- Competitive Pressure: Insurers adopting AI report significant reduction in operational costs compared to their peers.

By integrating AI, insurers can efficiently analyze data, detect risks, and optimize customer engagement strategies.

AI in Different Insurance Sectors

AI is being implemented across various insurance sectors to enhance efficiency, improve customer experiences, and drive innovation. Each sector benefits from AI’s ability to process vast amounts of data, predict trends, and automate tasks. Below is an overview of AI’s applications in different types of insurance:

1. Health Insurance

AI in health insurance has transformed underwriting, claims processing, and customer engagement. By analyzing health data and predicting potential health risks, insurers can offer personalized premiums and coverage.

- Risk Assessment: AI uses health data from wearables, medical records, and lifestyle choices to assess individual health risks and set premiums.

- Claims Processing: AI streamlines claim by automatically processing health claims, identifying fraudulent claims, and expediting payouts.

- Customer Support: AI-driven chatbots provide instant responses to queries related to policy details, claims, and benefits, improving customer service.

2. Life Insurance

In the life insurance sector, AI enhances underwriting, claims management, and customer interactions. AI solutions help insurers process applications faster and provide more accurate pricing.

- Predictive Underwriting: AI analyzes vast amounts of historical and personal data to better assess life expectancy and health risks, enabling more accurate underwriting decisions.

- Claims Automation: AI-powered platforms automate the claims process, reducing time and errors in claim settlements.

- Personalized Services: Life insurers use AI to recommend tailored policies and coverage options based on customer preferences and needs.

3. Auto Insurance

AI in auto insurance is revolutionizing underwriting, risk assessment, and claims processing, particularly through the integration of telematics and IoT data.

- Telematics and IoT: AI processes data from connected vehicles to assess driving behavior and set personalized premiums. For instance, drivers who exhibit safe driving habits may receive lower premiums.

- Claims Processing: AI helps assess damage and estimate repair costs by analyzing photos of accidents or damages through image recognition.

- Fraud Detection: AI models identify patterns of fraudulent claims and flag suspicious activities for further investigation.

4. Property and Casualty Insurance

AI applications in property and casualty (P&C) insurance are focused on underwriting, claims handling, and loss prevention.

- Risk Detection: AI uses data from IoT devices, such as smart home sensors, to monitor and predict property risks, such as fire or water damage, and adjust coverage accordingly.

- Claims Management: AI automates claims processing, allowing for faster and more accurate damage assessments using image recognition and other data analytics tools.

- Loss Prevention: AI analyzes property risk factors, offering preventive advice to customers, such as maintaining property or adjusting coverage to mitigate potential loss.

5. Commercial Insurance

AI is increasingly used in commercial insurance for risk assessment, claims management, and fraud detection. It enables insurers to offer tailored policies for businesses of all sizes, from small enterprises to large corporations.

- Risk Management: AI models analyze historical data, environmental factors, and industry-specific risks to provide personalized commercial coverage and risk mitigation plans.

- Claims Automation: AI-driven systems expedite commercial claims processing by automatically evaluating damage and calculating compensation.

- Fraud Prevention: AI identifies unusual patterns in claims and underwriting, helping insurers spot fraud early and reduce false claims.

6. Travel Insurance

AI is playing a key role in improving the customer experience and streamlining processes in the travel insurance sector.

- Claims Processing: AI expedites the processing of travel insurance claims by automating document reviews and assessing the validity of claims through pattern recognition.

- Personalized Offerings: AI leverages customer data to offer tailored travel insurance policies based on the traveler’s destination, age, and health conditions.

- Customer Engagement: AI chatbots assist customers in purchasing policies, making claims, and answering travel-related queries around the clock.

AI for the Insurance Industry: Who Does It Benefit?

AI impacts every stakeholder in the insurance ecosystem, bringing distinct advantages to insurers, policyholders, and intermediaries.

Insurers

- Efficiency Gains: AI reduces underwriting time by 30-40% and claim settlement time by 60%.

- Fraud Prevention: AI-powered fraud detection tools save insurers billions annually by identifying suspicious claims early.

- Enhanced Risk Modeling: Predictive analytics refine risk assessments, enabling more accurate pricing strategies.

Policyholders

- Faster Processes: Customers benefit from AI-driven claims systems, which approve and settle claims in as little as 24 hours.

- Personalized Policies: AI tailors coverage based on individual preferences, lifestyle data, and historical trends.

- 24/7 Support: Virtual assistants provide instant policy updates and claim status inquiries.

Agents and Brokers

- Increased Sales Efficiency: AI identifies upsell and cross-sell opportunities through predictive modeling.

- Actionable Insights: AI tools equip agents with recommendations to match customers with suitable policies.

AI and Insurance: Use Cases in Insurance

AI applications in insurance span every major function, driving both operational and customer-facing improvements.

1. Underwriting and Risk Assessment

AI is reshaping underwriting by using dynamic, real-time data to improve risk assessment and premium accuracy. Unlike traditional methods that rely on static models, AI processes continuous data streams, leading to more precise and personalized insurance offerings.

IoT Integration for Risk Profiling

AI can analyze data from IoT devices such as smart home sensors or vehicle telematics to assess risks more accurately. For example, smart home sensors detect potential hazards like water leaks or fires, alerting insurers to adjust coverage as needed. This integration helps create more accurate risk profiles for customers.

Behavioral Analysis for Premium Adjustments

AI leverages customer behavior, such as health data from wearables, to adjust premiums. A customer who maintains a healthy lifestyle may benefit from lower premiums. By incorporating personal health data, insurers can better align pricing with individual risk profiles, making the process more tailored and fairer.

2. Claims Processing

AI is streamlining claims processing by automating key tasks, detecting fraud, and accelerating settlements. This results in faster claims resolution, lower operational costs, and higher customer satisfaction.

Damage Assessment with AI

AI-powered image recognition analyzes photos or videos submitted by claimants to quickly assess the damage and estimate repair costs. This system improves the accuracy and speed of damage evaluations, reducing the time taken for claims to be processed.

Fraud Detection Using AI

AI uses pattern recognition to detect anomalies in claims data, such as inflated medical expenses or inconsistent information. By flagging suspicious claims, AI helps insurers minimize fraudulent activities, saving substantial costs.

Automated Claim Approvals

AI can automate the approval of simple claims, such as minor accidents or health reimbursements, speeding up the claims process. Automated claim summaries and fast payouts reduce the workload on human agents and ensure quicker resolution for non-complex cases.

3. Customer Engagement

AI enhances customer engagement by providing personalized, responsive services that cater to individual needs. With AI, insurers can offer more timely and efficient interactions, boosting customer satisfaction and loyalty.

AI-Powered Chatbots for Instant Support

AI chatbots are available 24/7 to answer common questions and provide updates on claims, policy details, or account issues. These bots reduce wait times and free up human agents to handle more complex inquiries, making customer support more efficient.

Personalized Product Recommendations

AI analyzes data like purchasing behavior and policy history to recommend tailored insurance products. For example, if a customer buys a new car, AI might suggest an auto insurance policy that fits their specific needs. This personalization not only enhances the customer experience but also increases the likelihood of policy adoption.

Sentiment Analysis for Service Improvement

AI sentiment analysis monitors customer interactions to gauge satisfaction levels. By analyzing feedback from various touchpoints, such as calls or social media, insurers can identify negative sentiments early and address issues before they escalate. This proactive approach improves customer service and strengthens client relationships.

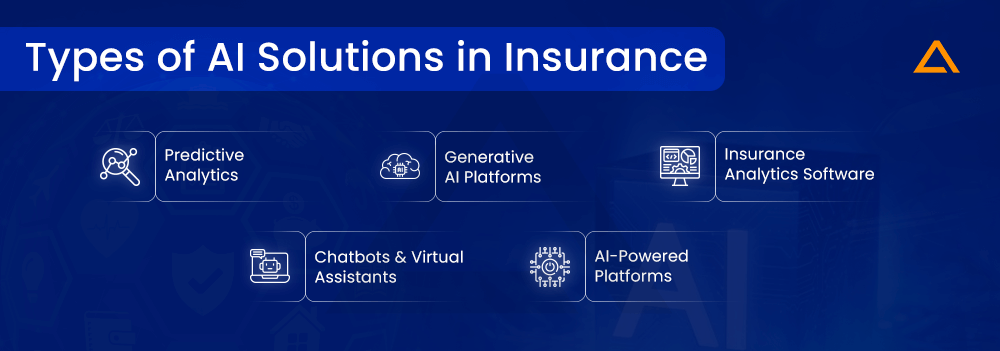

Types of AI Solutions in Insurance

AI solutions vary depending on the insurer’s needs, ranging from predictive analytics to fully integrated platforms.

1. Predictive Analytics

- Forecasts customer behavior, claims frequency, and risks using AI models.

- Helps insurers make proactive decisions based on data-driven insights.

- Identifies high-risk customers and potential policy cancellations.

- Improves pricing models and risk assessment accuracy.

2. Generative AI Platforms

- Automates policy creation, claims reporting, and scenario testing.

- Generates draft documents and claim summaries based on customer data.

- Speeds up administrative tasks and reduces manual effort.

- Enhances productivity across various departments within the insurer’s organization.

3. Insurance Analytics Software

- Provides real-time insights into claims trends, fraud patterns, and customer behavior.

- Analyzes vast datasets for emerging risks and performance tracking.

- Helps insurers make informed, data-driven decisions.

- Detects fraud patterns and suspicious claims in real-time.

4. Chatbots and Virtual Assistants

- Handles routine customer inquiries, policy updates, and claim status checks 24/7.

- Frees up human agents for more complex, high-touch interactions.

- Improves response times and customer satisfaction.

- Reduces operational costs by automating repetitive tasks.

5. AI-Powered Platforms

- Integrates underwriting, claims management, fraud detection, and customer engagement into one platform.

- Streamlines processes by consolidating key insurance functions.

- Provides a holistic view of customer data for personalized service.

- Enhances collaboration across departments and speeds up decision-making.

Wrapping Up!

AI is not just transforming how insurers operate; it is setting a new benchmark for efficiency, innovation, and customer-centricity in the industry. From underwriting to claims processing and customer engagement, AI has become an indispensable tool for insurers to stay competitive and address industry challenges.

The future of insurance lies in the continued adoption of AI-powered platforms, generative AI tools, and advanced analytics, ensuring insurers deliver greater value to all stakeholders. Embracing AI is not optional – it is a strategic imperative for insurers ready to thrive in a rapidly changing world.

Say

Say