Quick Summary:

AI-powered Assistants are changing how insurance companies work, and it goes far beyond just answering customer questions. These smart assistants help automate claims, support underwriting, and improve customer service by connecting with systems like CRMs and claims platforms. With technologies like conversational AI and natural language processing, they work 24/7, reduce costs, and deliver more personalized experiences.

Let’s be honest: insurance hasn’t always been the easiest industry to deal with.

Customers often face:

- Long wait times just to get basic help

- Delays in claims processing

- Confusing policy language

- And limited support after hours

At the same time, expectations have changed. People want fast answers, simple experiences, and 24/7 support just like they get from their favourite apps and services.

This is where AI Assistants in insurance are making a real difference.

Unlike older bots that could only follow fixed scripts, today’s Assistants use conversational AI and natural language processing (NLP) to understand real questions, guide users through complex steps, and even complete tasks automatically like checking claim status or updating policy details.

They work quietly in the background, connecting with systems like:

- CRM platforms

- Claims processing tools

- Underwriting databases

All to deliver quick, helpful answers without needing a human agent every time.

In this blog, we’ll explore how these smart insurance Assistants work, where they bring the most value, and why more insurers are using them to improve claims, underwriting, and customer engagement.

How AI Assistants Work in Insurance?

If you’ve ever interacted with a Assistant that just repeats menu options or responds only when you type specific keywords, you’ve met a rule-based bot. They’re like automated phone menus; they can only follow a fixed path and often get stuck when someone asks something unexpected.

But AI-powered insurance Assistants are a different story.

They don’t just follow a script they understand intent, context, and nuance.

Let’s break that down.

Rule-Based Bots vs AI-Powered Insurance Assistants

| Feature | Rule-Based Bot | AI-Powered Insurance Assistant |

| Response Logic | Pre-set flows and keywords | Learns from patterns and context |

| Flexibility | Limited – breaks with unexpected input | High – understands natural language |

| Use Cases | FAQs, basic navigation | Claims, quotes, policy updates, lead gen |

| Tech Behind It | Decision trees | NLP, machine learning, conversational AI |

With conversational AI and NLP in insurance, modern Assistants can:

- Understand what a customer is asking, even if it’s phrased differently

- Pull the right information from backend systems

- Respond like a helpful, informed human

How a Assistant Understands and Responds?

A good AI Assistant for insurance follows a three-part system:

-

Intent Detection

Using NLP (natural language processing), the Assistant identifies what the user wants to do.

Example: “I want to file a claim” → the bot understands the action = start claim process

-

Backend Integration

The bot pulls data or takes action by connecting with systems like:

- CRM tools (like Salesforce, HubSpot) to fetch customer history

- Claims management platforms to check claim status or create new entries

- Underwriting systems to pre-qualify based on risk data or documents

-

Generative AI Response

The Assistant replies in natural, helpful language like explaining policies, guiding the process, or even upselling relevant coverage options.

“Your car claim is in the final review stage. Based on your plan, expect reimbursement within 5 working days.”

This trio understands, connects, and responds making AI chatbots more than just digital assistants. They become an always-on, well-informed team member.

Core Benefits of AI Agent in Insurance

AI Assistants in insurance are no longer just answering FAQs. They’re quietly becoming the digital backbone of claims, underwriting, and customer support teams showing up where people need help, and doing it faster, cheaper, and often more accurately.

Let’s break down what makes them such a game-changer:

Claims Automation & Management

Filing an insurance claim used to feel like pulling teeth problems such as, long forms, long calls, and even longer wait times. But AI Chatbot in insurance are rapidly changing that. Today, customers can initiate, track, and resolve claims right from their phone with responses that feel less like scripts and more like real conversations.

Let’s look at how AI-powered insurance Assistants streamline the claims process from end to end:

Fast-Track Claims Processing

The days of paperwork pileups and email threads are fading. With conversational AI, policyholders can file a claim in real time through web chat, mobile apps, or even voice.

The Assistant collects key details (policy number, incident date, type of loss), validates inputs, and logs the First Notice of Loss (FNOL) instantly into the claims management system.

Example Interaction Customer: “Hi, my apartment was flooded last night. How do I report it?”

AI Assistant: “I’m here to help. Can you confirm the date of the incident and upload a photo of the damage?”

This simple dialogue replaces hours of phone tag and paperwork and reduces error-prone manual entries by syncing directly with your internal systems.

FNOL via Conversational Interfaces

First Notice of Loss (FNOL) is a critical trigger in the claims lifecycle. Traditionally handled by call center agents, it’s now easily automated through chat.

AI Assistants capture loss details, validate policy coverage, and check for duplicate entries all in one seamless flow. With 24/7 availability, claims can be initiated outside business hours without delay.

Preliminary Claim Assessment Using NLP & Images

Today’s AI insurance Assistants go beyond data collection, they understand what’s being submitted.

By using NLP (Natural Language Processing) and computer vision, bots can read descriptions, classify claim types, and even analyze uploaded images (e.g., car damage, property loss) to assign severity levels.

This early triage helps prioritize high-impact cases and route them faster.

Real-Time Claims Status Updates

No more “We’ll get back to you.” AI-powered Chatbots integrate with policy admin and claims platforms to provide real-time updates.

Whether it’s confirming documentation, showing claim progression, or providing estimated resolution times so, users stay informed without chasing agents.

“Your home insurance claim was approved and is now with the payments team. Expect a payout within 48 hours.”

It’s fast, transparent, and customer-centric.

Automated Claim Routing

Based on the complexity and urgency of the claim, Assistants can automatically route cases to the right adjuster, department, or region saving hours of internal coordination.

This is especially critical during surges (e.g., post-storm or wildfire claims) when quick triage and smart distribution reduce bottlenecks and stress on teams.

AI-Powered Fraud Detection

Insurance fraud is a silent drain on profitability. AI Assistants can help flag anomalies early like multiple claims from the same device, inconsistent timestamps, or mismatched policy details.

These digital assistants don’t just collect info, they cross-verify it across systems, enabling insurers to spot red flags in real time.

And since every interaction is logged, it also supports compliance and audit trails by ensuring accuracy, accountability, and legal defensibility.

Underwriting Intelligence & Risk Assessment

If claims are where policyholders feel the impact, underwriting is where insurers shape it. It’s the invisible engine that powers profitable decisions. But even experienced underwriters often juggle incomplete data, manual inputs, and tight timelines. That’s where AI-powered insurance Assistants step in not to replace underwriters, but to make their decisions sharper, faster, and more consistent.

Let’s explore how AI Assistants transform underwriting from reactive form-filling into a proactive, data-first process:

Smarter, Data-Backed Underwriting Support

Imagine this: an applicant submits a request for a high-value life insurance policy. Within seconds, the AI Chatbot pulls prior applications, medical disclosures, income data, and risk indicators from your CRM all before the underwriter even looks at it.

By surfacing contextual data at the point of decision, AI Assistants in insurance help underwriting teams move faster without compromising risk integrity.

Example:

🧑💼Underwriter: “Has this applicant ever been declined before?”

🤖 Assistant: “Yes, in 2022 due to missing cardiac reports. Resubmitted with new documents.”

Now that’s operational clarity.

Predictive Risk Scoring for Faster Decision-Making

Advanced AI systems integrated with Assistants can analyze applicant patterns and apply predictive models to score risk in real time.

Rather than relying on static rules, bots use past claims data, demographics, and behavioral insights to suggest likelihood scores for approval, referral, or denial.

This real-time guidance not only speeds up the process but also ensures greater underwriting consistency across teams.

For insurers, that means fewer missed red flags and fewer unnecessary delays.

Automated Input Verification from CRMs & Forms

Let’s face it.. data entry is prone to error. A single mistyped birthdate or mismatched occupation code can derail an application.

AI-powered insurance Assistants automatically verify entries from web forms and CRM systems, ensuring the data is clean, complete, and properly categorized before it reaches the underwriter.

They can even flag missing KYC documents or cross-check employment info against third-party databases by taking repetitive validation off your team’s plate.

Flagging Outlier Profiles for Manual Review

Not every application is straightforward and that’s exactly where Assistants shine as the first line of defense.

When a profile deviates from established norms (e.g., an unusually high coverage request for a high-risk occupation), the bot flags it for deeper human inspection.

This smart triaging helps underwriting teams focus their expertise where it’s truly needed like on the edge cases, not the routine.

Customer Engagement & Self-Service

insurance isn’t something people think about until they absolutely need it. And when they do, they expect quick, clear answers. Whether it’s updating a policy, checking a claim, or just trying to get a quote they want help now, not after sitting on hold or digging through forms.

That’s where AI-powered insurance Assistants deliver real value by becoming the always-on, always-ready digital front door to your business.

24/7 Insurance Customer Support

Customers don’t stick to office hours, and neither should your support. With an AI Assistant integrated into your insurance platform, support becomes available around the clock and not just during business hours.

Whether it’s a quick question about deductible limits at 11 PM or help with a missed payment on a Sunday, the Assistant:

- Responds instantly

- Escalates to a human only when needed

- Keeps customers from dropping off in frustration

Natural Language Responses to Complex Queries

Let’s say a customer types:

“Does my policy cover theft from a parked vehicle while traveling overseas?”

A rule-based bot would likely get confused. An AI Assistant trained in insurance terminology, on the other hand, uses natural language processing (NLP) to:

- Understand the actual intent

- Reference relevant policy clauses

- Respond with a clear, accurate answer in plain English

It’s not just about answering questions but it’s about building confidence with every interaction.

Multilingual Assistant Support

For insurers operating in diverse regions, language accessibility matters. AI Assistants now offer multilingual support that goes beyond simple translation.

They can:

- Detect the user’s preferred language automatically

- Adapt tone and phrasing based on cultural context

- Maintain accuracy in regulatory or legal language

That means every customer feels understood, no matter where they’re from or what language they speak.

Quote Generation via Conversational Flow

Instead of sending users through lengthy quote forms, Assistants can guide them step-by-step in a friendly, conversational tone:

🤖 “What type of coverage are you looking for today?”

🤖 “And what’s the value of the asset you’re insuring?”

Behind the scenes, the Assistant pulls from rating engines or quote systems, giving customers:

- Real-time estimates

- Coverage options

- A clear CTA to continue or connect with an agent

This shortens the sales cycle and increases conversion.

Onboarding Assistance for Policyholders

New customers often have questions like:

- “Where do I upload documents?”

- “What happens after I purchase a policy?”

AI Assistants smooth the onboarding journey by:

- Explaining next steps

- Offering live links or uploads within chat

- Triggering reminder messages when tasks are pending

Think of it as a digital insurance concierge, guiding new policyholders with ease.

KYC & Document Collection Support

Collecting documents is one of the most tedious parts of insurance onboarding. But with AI Assistants:

- Users can upload KYC files directly in the chat window

- The bot can validate formats (e.g., PDF, JPEG)

- Missing fields or mismatches can be flagged immediately

It’s faster for the customer, and cleaner for your back office.

Sales, Renewals & Marketing Enablement

Sales in insurance isn’t just about selling policies but it’s about building trust, educating prospects, and keeping the conversation alive throughout the customer lifecycle. But here’s the catch: most marketing campaigns and renewal processes still rely on outdated emails, call follow-ups, or paper notices that get ignored or delayed.

That’s where AI-powered insurance Assistants step in and bridging the gap between intent and action, in real time.

Lead Qualification Through Smart Conversational Flows

Not every website visitor or inbound inquiry is sales-ready and human agents shouldn’t waste time chasing cold leads. Instead, an AI Assistant for lead generation can greet visitors, ask qualifying questions, and automatically score them based on their responses.

Example:

Prospect: “I’m looking for life insurance for my parents.”

Assistant: “Great! Are they currently insured? What’s their age range?”

Based on this info, the bot routes the lead to the right team with full context.

This kind of automated lead qualification helps agents prioritize high-intent prospects while ensuring no one falls through the cracks.

Cross-Selling & Upselling Based on Customer Profiles

Imagine a Assistant that doesn’t just respond but recommends. By pulling data from policyholder profiles and past purchases, Assistants can proactively suggest complementary coverages or higher-value plans based on user behavior and life changes.

“You’ve recently moved to a new city, would you like to explore renter’s insurance?”

These contextual nudges are more effective than cold pitches and when delivered conversationally, they feel like helpful suggestions, not sales tactics.

Renewal Reminders & Assisted Policy Updates

One of the most common reasons for policy lapses? Customers simply forget. A 24/7 insurance Assistant can handle reminders, notify users about upcoming renewals, and even walk them through updating contact information or payment methods.

“Hi Sara, your auto policy is set to renew in 5 days. Would you like to review your details or proceed with renewal now?”

This seamless experience improves retention without adding to your team’s workload by boosting revenue and customer satisfaction in one stroke.

Campaign Follow-Up Automation via Chat

Running a limited-time offer or launching a new product line? Traditional campaigns often lose momentum after the first email blast. But Assistants can follow up automatically, re-engaging leads via web chat, WhatsApp, or mobile apps with timely nudges.

Even better, you can tailor responses based on previous interactions making your outreach feel more personal and less robotic.

Internal Operations & Employee Enablement

While most people associate insurance Assistants with customer service, their real magic often happens behind the scenes quietly empowering your internal teams, reducing information overload, and making day-to-day operations more efficient.

In fact, AI-powered insurance Assistants are becoming indispensable for agents, underwriters, HR teams, and operations managers alike. Here’s how they’re reshaping internal workflows from the ground up:

Agent-Facing Knowledge Assistant

Every second counts when an agent is on a call with a policyholder. Instead of scrambling through PDFs, email threads, or old training decks, agents can now ask an internal Assistant questions and get instant, accurate answers.

👤 Agent: “What’s our underwriting rule for diabetes Type 2?”

🤖 Assistant: “Applicants over 50 with well-controlled Type 2 may qualify for Standard rates. Would you like to view the guideline doc?”

Whether it’s policy guidelines, product details, or claims procedures, a knowledge assistant gives your frontline staff the information they need and right when they need it.

AI for Document Summarization & Policy Lookup

Insurance documents aren’t exactly light reading. AI Assistants can summarize lengthy documents, highlight key clauses, or even fetch specific sections on demand by saving hours of manual scanning.

Need to reference exclusions in a commercial policy? Or pull the last renewal date for a client? The Assistant can fetch that from your internal system or document repository in seconds.

HR & IT Helpdesk Support for Employees

Internal support queries from forgotten passwords to payroll clarifications slow down your HR and IT teams. An internal AI Assistant for employee support can automate answers to:

- Leave policies

- Reimbursement processes

- Laptop provisioning

- VPN or system access

By handling repetitive tickets, the bot frees up HR and IT to focus on more strategic tasks while still keeping employees supported.

Meeting Scheduling, Summarization & Task Reminders

Need to book a meeting with underwriting, send a follow-up to a client, or prep a task list after a claims discussion?

Internal AI assistants can integrate with calendars and email systems to:

- Suggest meeting slots

- Summarize meeting notes using transcription

- Send automated task reminders to agents or adjusters

Think of it as a digital executive assistant for your teams.

Training & Onboarding Assistants for New Hires

Bringing new agents or claims handlers up to speed is time-consuming. Assistants can act as 24/7 onboarding coaches, guiding employees through:

- Tools and portals

- Standard procedures

- Compliance modules

- Product knowledge

New hires can ask questions in natural language and get context-specific answers by cutting down ramp-up time significantly.

Ticket Routing and Email Draft Support

Instead of manually forwarding emails or trying to write perfect replies under pressure, agents can now:

- Use a bot to draft responses to FAQs

- Let the bot route complex tickets to the right department based on keywords and customer history

This ensures faster resolutions and fewer internal misroutes by keeping both teams and customers happy.

Compliance, Legal & Regulatory Assistance

In insurance, staying compliant isn’t just good practice, it’s mandatory. Regulations evolve fast, legal scrutiny is high, and audit trails need to be airtight. That’s where AI-powered insurance Assistants step in not just as assistants, but as guardrails that ensure nothing slips through the cracks.

Let’s walk through how conversational AI is quietly becoming a trusted partner in the compliance and legal workflow of modern insurers.

Regulatory & Compliance FAQ Assistant

Ever had a team member ask, “Are we still using that old KYC form?” or “What’s the updated IDV rule in Florida?”

Instead of digging through legal PDFs or emailing compliance officers, employees (and in some cases, customers) can now get instant answers via a compliance Assistant trained on internal regulatory documentation.

👤 Agent: “Can I approve a claim with missing driver’s license info?”

🤖 Assistant: “Not without documentation. Please follow the updated KYC guideline issued on Jan 1, 2024.”

These bots:

- Ensure consistent answers across departments

- Reduce the burden on compliance teams

- Stay updated as regulations evolve

This minimizes human error and maximizes audit readiness.

Legal Document Summarization

Insurance contracts, terms & conditions, and regulatory circulars aren’t written for speed reading. AI Assistants can:

- Summarize long legal documents into key takeaways

- Highlight exclusions, clauses, or renewal terms

- Break down complex language into plain-English responses

Whether it’s a new agent trying to understand policy limitations or a legal team reviewing endorsements, these bots serve as on-demand legal translators without compromising context.

Audit Trail & Process Logging Support

One of the key challenges in compliance audits? Proving what was done, when, and by whom.

Well-designed insurance Assistant platforms can log:

- Every customer interaction

- Every document shared or requested

- Every compliance prompt shown and acknowledged

These logs become part of a transparent audit trail, helping insurers demonstrate process adherence and due diligence whether it’s for internal reviews, regulator requests, or legal defense.

Some Assistants even generate downloadable audit summaries or trigger alerts when a process step is skipped, ensuring no part of the compliance workflow is left unchecked.

Operational Intelligence & Continuous Optimization

Most insurance firms already track KPIs like claim turnaround time, policy conversion rates, or customer satisfaction. But here’s the truth: these numbers don’t tell you why a process is lagging or where a customer gets frustrated.

That’s where AI-powered Assistants come in and not just as support tools, but as a real-time operational intelligence layer that helps you measure, learn, and improve.

Let’s unpack how this works.

KPI Monitoring & Performance Analytics

Your Assistant isn’t just answering questions, it’s generating data 24/7. Every query, every completed task, every dropout is a datapoint.

AI Assistant platforms for insurance can track:

- Resolution rates

- Escalation trends

- Session length vs. success rates

- Common intents that lead to agent handoffs

This allows operations leaders to measure what matters from the effectiveness of claims automation to how well the Assistant handles renewal queries without human intervention.

With real-time dashboards, teams can spot bottlenecks early and fix them before they impact customer satisfaction or compliance

Pattern Recognition from Chat Logs

Sometimes, what’s buried in thousands of chat conversations is more telling than structured KPIs.

AI Assistants can automatically:

- Surface recurring pain points (e.g., “Where’s my refund?” showing up 3x more this month)

- Flag policy terms or processes that confuse users

- Identify which products cause the most post-sale questions

This kind of pattern recognition enables proactive process improvement, allowing teams to adjust not just the Assistant but the business itself.

Customer Feedback Collection via Chat

Instead of sending generic email surveys (that rarely get answered), insurance Assistants can prompt for feedback right after a live interaction:

🤖 “Was I able to help you resolve your claim today?”

👍 Yes / 👎 No

💬 “Any suggestions for how I could improve?”

Simple, conversational, and frictionless, this builds a feedback loop that actually works. Teams can monitor CSAT trends, detect service gaps, and iterate quickly.

Bonus: unhappy responses can be flagged for immediate human follow-up, helping you rescue churn before it happens.

Custom Insights via Data Blending from Dashboards

AI-powered insurance Assistants don’t just answer questions they collect rich interaction data. When integrated with your CRM and BI tools, this data becomes a goldmine for uncovering trends and performance gaps.

Assistants can automatically:

- Tag conversations by product, sentiment, or intent

- Sync chat events with claim status or policy changes

- Feed structured logs into dashboards for analysis

This enables insights like:

- Premium queries tied to recent coverage changes

- Negative sentiment during claims linked to higher churn

- High inquiry volume around specific policy clauses

With AI doing the tagging and pattern detection, insurers can make faster, smarter decisions and improve both service and strategy in real time.

Strategic Business Outcomes

Deploying an AI Assistant in insurance isn’t just a tech initiative, it’s a strategic decision that reshapes how your business operates, serves, and scales. While automation and customer support might be the starting point, the long-term benefits span cost savings, efficiency, decision-making, and brand loyalty.

Let’s explore how those results play out across the insurance value chain.

Reduced Operational Costs Across Functions

When AI Assistants take over high-volume, repetitive conversations like premium due dates, claim status updates, or basic KYC queries they free up human agents to focus on high-touch, high-impact work.

Instead of needing to hire more agents during open enrollment or storm seasons, insurers can:

- Rely on Assistants to absorb volume surges

- Cut average handling time for simple queries

- Reduce dependency on outsourced call centers

It’s not just about cutting costs but it’s about smarter allocation of people and processes.

Scalable, Always-On Customer Support Model

Traditional insurance support models break under pressure during:

- Catastrophic events

- Peak renewal periods

- Regulatory deadlines

AI-powered insurance Assistants don’t.

They’re available 24/7, across web chat, mobile apps, WhatsApp, or SMS. Whether it’s a claim submission at 2 AM or a quote inquiry on a weekend, Assistants:

- Eliminate wait times

- Provide consistent answers

- Maintain brand tone and accuracy

That kind of availability builds trust especially when urgency meets emotion, as it often does in insurance.

Increased Efficiency in Claims & Policy Management

Let’s take a step back and discuss how much time do your teams spend:

- Clarifying policy coverage?

- Manually collecting documents?

- Following up on missing details?

AI Assistants optimize all of it:

- Pre-fill known data from CRM or previous chats

- Prompt users contextually for uploads or signatures

- Escalate automatically when something falls outside the rules

It means claims get filed correctly the first time, policy changes are cleaner, and cycle times shrink without burning out your workforce.

Enhanced Customer Satisfaction and Loyalty

The insurance experience can feel cold, slow, or opaque. Assistants flip the script by:

- Offering fast, accurate help

- Explaining policy language in plain English

- Providing proactive nudges (e.g., “Your premium’s due next week. Want help renewing?”)

Customers feel in control. They get answers, updates, and reminders in the channels they already use and without feeling “sold to.”

Over time, that builds loyalty, reduces churn, and improves Net Promoter Score (NPS).

Data-Driven Decision Support Across the Lifecycle

Most insurers already track performance metrics, but AI Assistants add another layer: the “why” behind the numbers.

By analyzing:

- Chat volume by topic

- Drop-off patterns in quote flows

- Sentiment trends around product features

- Feedback collected post-chat

You get actionable insights to:

- Improve policy language

- Fix confusing workflows

- Refine marketing messaging

- Personalize future touchpoints

All without running a single focus group. That’s the real power of operational intelligence driven by conversational AI.

Looking for BFSI IT Solutions?

Get fast-track BFSI digital transformation with secure, scalable solutions!

Key Use Cases of AI-Powered Insurance Assistants

AI Assistants for insurance are no longer just digital assistants they’re operational teammates. From onboarding to renewals, they now support nearly every touchpoint of the customer journey. Let’s walk through how they’re making a real difference.

Submitting & Tracking Claims

Imagine this: A customer just had a small car accident. Instead of sitting on hold or dealing with a confusing website, they simply pull out their phone and open a Assistant.

Assistant: “Hi Sam, I see you’re covered under your auto policy. Would you like to start a claim for your recent accident?”

User: “Yes.”

Assistant: “Great, I’ll guide you through it. First, can you upload a photo of the damage?”

From there, the AI Assistant walks them through step by step, with no jargon. This kind of claims automation not only reduces errors but also trims down claim resolution times from days to hours.

Used by: A well-known global insurer uses an AI claims Assistant to intelligently triage requests guiding users to the right self-service resource or escalating them to a live agent when needed.

Policy Renewals & Payments

Renewal emails often get buried, payment links expire, and customers forget their policy timelines. This can cause avoidable lapses in coverage and unnecessary customer churn.

Enter the AI-powered insurance Assistant. These bots can monitor policy lifecycles in real time, proactively nudge customers with personalized reminders, and even handle payment flows directly within the chat interface.

Example Scenario:

Bot: “Hi Ana, just a heads-up, your auto policy renews on June 25. Would you like to review the updated terms or proceed with payment?”

User: “Show me the changes.”

Bot: “Your premium has been adjusted due to lower mileage. New premium: $415/6 months. Want to renew now?”

User: “Yes, go ahead.”

The result? Renewals happen on time, premiums are communicated transparently, and payments get completed with a tap all without involving a human agent.

Leading insurers use such automated flows to reduce missed renewals, boost customer satisfaction, and offload routine service requests from human agents.

Quote Generation

Getting an insurance quote used to mean long calls, dense forms, and waiting for callbacks. That’s a lead killer.

AI Assistants flip the script.

By gathering basic information (like location, coverage type, risk profile), the bot instantly calculates and delivers real-time quotes backed by underwriting logic and connected databases.

Example Scenario:

Bot: “Hi Jason! I can help you get a renters insurance quote. What’s your ZIP code?”

User: “85004.”

Bot: “Got it. Any valuable electronics or jewelry to cover?”

User: “Yes, around $2,500 worth.”

Bot: “Thanks! Based on your inputs, your quote is $11.70/month. Want me to email the policy or connect you to an advisor?”

This conversational quote generation improves transparency and drives conversions especially among digital-first customers who expect speed.

Modern insurers are now using AI Assistants to handle everything from quote generation to policy binding often completing the entire process in under two minutes, without any human intervention.

Lead Qualification & Cross-Sell Suggestions

When a user lands on your website, your AI Assistant doesn’t just say “Hi”, it gets to work. By asking smart questions, it qualifies leads in real time and segments them by product interest.

Better yet, based on the user’s life stage, history, or browsing behavior, it can suggest cross-sell opportunities (like bundling home and auto policies).

Example: One digital insurer reports that its AI Assistant handles nearly a third of all incoming queries resolving over 90% of them in just a few messages, often while proactively recommending relevant products or policy upgrades.

Agent Support & Training

AI Assistants aren’t just for policyholders. Internal-facing bots are transforming how insurance agents access information, onboard themselves to new products, and handle compliance questions on the fly.

Instead of flipping through PDFs or emailing their manager, agents can query an internal Assistant:

Agent: “What’s the deductible on our latest flood policy?”

Bot: “$2,000 standard; can be adjusted to $1,000 for an added premium.”

Agent: “Any exclusions?”

Bot: “Excludes mold, sewer backups, and damage to outdoor property.”

These bots are trained on internal manuals, regulatory docs, and FAQs, making them a powerful knowledge companion for brokers and CSRs (Customer Service Reps). They also reduce training time and maintain consistency in the field.

Insurers are increasingly leveraging AI assistants to support both policyholders and internal staff by accelerating onboarding processes, minimizing manual mistakes, and helping ensure compliance with regulatory requirements.

Best Practices for Implementing and Scaling Insurance AI Assistant

AI Assistants can deliver real, measurable value for insurance providers but only if implemented strategically. Whether you’re improving claims handling or automating routine inquiries, success hinges on how you roll out, integrate, and scale your solution. Here’s how to get it right from day one.

Start with a Focused Use Case That Drives ROI

Before trying to automate everything, pick one use case that’s high-volume, high-friction, and easy to measure.

Examples:

- Claims submission or status tracking

- Policy renewals and premium reminders

- Lead qualification on landing pages

Starting small lets you prove value quickly, gather real feedback, and avoid the complexity of a full-scale deployment. For instance, a Assistant for claims automation can reduce form errors, speed up intake, and free up human agents for higher-value tasks all while improving the customer experience.

This first use case becomes your foundation. Once refined, it can be replicated across other workflows.

Integrate with Your Existing Systems

A Assistant without system access is limited to basic queries. The real power comes when it’s connected to your:

- CRM (like Salesforce) for personalized service

- Claims management software for real-time updates

- Underwriting platforms to support decision-making

- Internal knowledge bases for consistent, accurate answers

For example, an AI Assistant for insurance can retrieve a customer’s policy details or payment history instantly something that would otherwise take minutes of agent time.

System integration also ensures data accuracy, reduces duplication, and enables compliance tracking from day one.

Build Human Escalation Into the Process

Even the best AI Assistant won’t handle every request. That’s why a clear and fast hand-off process to human agents is essential.

Set rules for when the bot should escalate such as emotional language, unsupported requests, or incomplete data and ensure it transfers the chat context (conversation history, customer data) to the agent seamlessly.

This hybrid support model not only improves resolution rates but also boosts customer confidence, knowing a human is always within reach when needed.

Track Performance and Continuously Improve

Your Assistant is not a “set it and forget it” tool. Like any customer-facing system, it requires monitoring, tuning, and ongoing optimization.

Use Assistant analytics to track:

- Resolution rate

- Escalation volume

- Average handling time

- Customer satisfaction scores

Set up regular reviews of Assistant performance and retrain it based on real interactions. Feedback loops either from users or support staff can uncover gaps in intent recognition or outdated policy details.

This process helps your Assistant evolve with customer expectations and regulatory changes.

Plan for Scalability from the Start

If your bot works well during regular business cycles but struggles during renewal season or after a major event, it can hurt more than help.

Choose platforms that offer:

- Cloud-native scalability (so traffic spikes won’t crash the system)

- Multilingual support (to reach a broader audience)

- Omnichannel deployment (to engage users via website, mobile app, WhatsApp, or SMS)

A scalable, secure insurance Assistant becomes a long-term digital asset—supporting growth, improving margins, and reducing dependency on manual processes.

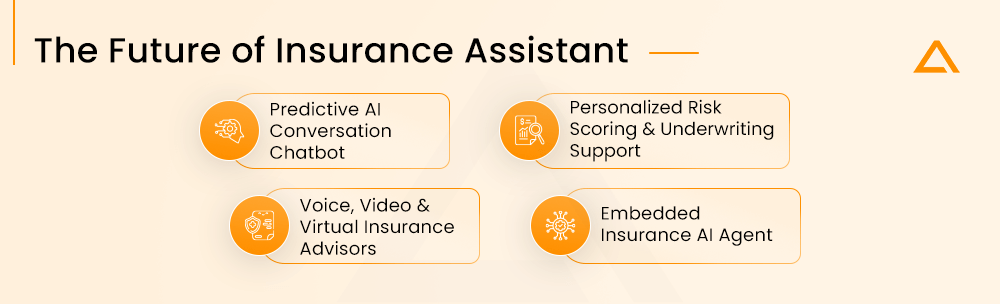

The Future of Insurance Assistants

For many insurers, AI Assistants have already transformed customer service by automating claims, assisting with policy renewals, and answering thousands of questions without missing a beat. But that’s just the beginning. The next chapter in insurance Assistant evolution isn’t about doing more of the same and it’s about doing things differently.

We’re moving from basic automation to intelligent anticipation, where Assistants don’t just react to problems but help prevent them altogether.

A Smart AI Conversation Assistant from Reactive to Predictive

Traditionally, insurance has followed a “detect and repair” approach. A policyholder files a claim after damage is done. But with predictive AI and real-time data integration, insurance Assistants can help shift that mindset to “predict and prevent.”

For example:

AI Assistant: “Hi Alex, based on recent storm alerts and your ZIP code, we recommend moving your vehicle to a covered area. Want us to send tips for minimizing hail damage?”

This is no longer science fiction. Assistants powered by predictive AI in insurance can tap into weather APIs, policy databases, and IoT sensors to offer timely advice reducing risk and claims before they even occur.

This shift isn’t just good for insurers it builds real trust with customers.

Personalized Risk Scoring and Underwriting Support

We’re entering an era where underwriting is no longer a one-size-fits-all process. AI Assistants can now collect real-time behavioral data and assist underwriters by:

- Asking contextual, adaptive questions based on customer responses

- Scoring risks dynamically (e.g., driving habits, location history)

- Recommending personalized coverages during the onboarding journey

For instance, a conversational AI Assistant could ask:

“Do you work remotely or commute daily? This helps us adjust your auto premium more accurately.”

This level of personalized risk scoring helps insurers offer smarter, fairer pricing while improving conversion and retention rates.

Voice, Video & Virtual Insurance Advisors

The future interface may not even be a chat window. We’re already seeing prototypes of voice-enabled Assistants that work via smart speakers, IVRs, or in-app voice commands. Imagine asking your virtual insurance advisor:

“What’s my deductible for dental coverage?”

“Can you file a windshield claim for me?”

Add facial recognition and video support, and suddenly your AI assistant becomes a trusted digital advisor that can see, hear, and assist almost like a real agent, minus the wait time.

This evolution will deepen the role of AI-powered Assistants in customer loyalty, as interactions feel more natural, proactive, and human.

The Rise of Embedded Insurance AI Agent

Assistants won’t be limited to insurer websites or apps. With embedded insurance, they’ll appear wherever customers are on car dealership portals, e-commerce checkouts, or travel booking sites offering contextual, instant coverage options.

Picture this:

You’re buying a used car online, and an embedded insurance Assistant pops up:

“Want to see affordable coverage options for this exact vehicle? We’ve pre-filled your details.”

This kind of frictionless experience will reshape distribution models and make insurance more accessible and less intimidating for the everyday customer.

Seeking brilliance in the AI/ML universe?

Look no further!

Conclusion

AI Assistants are no longer just a digital add-on they’re reshaping how insurers handle claims, underwriting, and customer service. By automating routine tasks and enabling 24/7 support, they boost efficiency and elevate the customer experience. More importantly, they free up human teams for higher-value work. Insurers that embrace these tools today will lead the industry tomorrow. The future of insurance is conversational, and it’s already here.

Ready to future-proof your insurance operations? Aglowid helps you build secure, scalable AI Assistants tailored for claims, underwriting, and 24/7 customer engagement. Start innovating today……

Say

Say