Over the years, the FinTech industry has grown exponentially and this credit goes to the developments in technologies like blockchain, artificial intelligence, biometrics, and machine learning.

Today investments in the FinTech domain is growing high and the global investment has reached $8.2 billion, with a significant part of the FinTech opportunities stay in the areas of automation and digitization, mobile, open APIs, data analytics and exploring new business models.

It is said that around 54% of banks are now finding FinTech to be beneficial and partnering with it and 50% of customers are involved with at least one FinTech firm services.

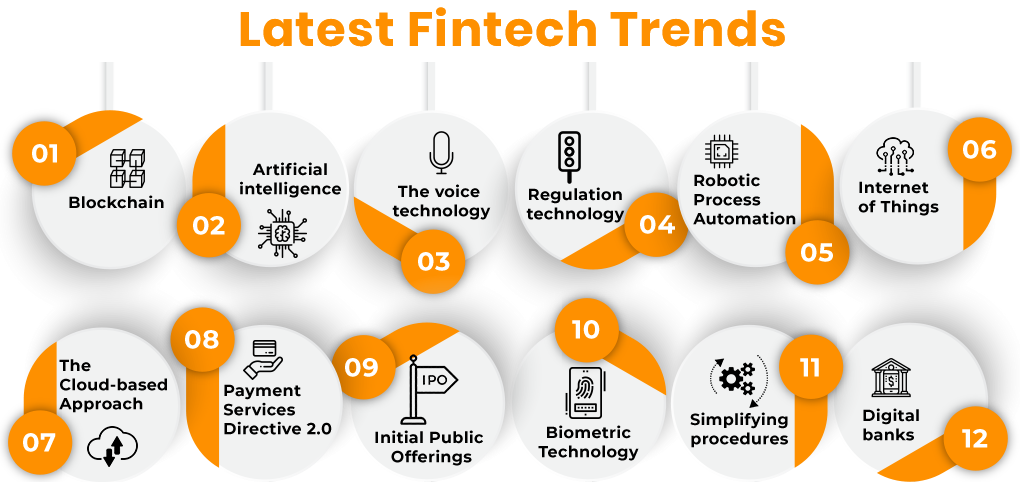

Blockchain

It is a fact that much has been talked about blockchain in the past, but FinTech is the one who managed to get the most out of this technology. As per the report of PwC, it is said that around 77% FinTechs will go ahead and adopt blockchain by the year 2021. The main reason to go ahead with this technology extensively is the security it offers. Blockchain is capable to update the digital ledger online automatically as well as records transactions without letting anyone have access to the stored data. If we look at the status of blockchain, you will realize that 2018 was a difficult year for it. The other technologies which work with blockchain have also experienced a considerable downfall. Still, experts believe that many companies will come forward and adopt blockchain services in 2023.

Artificial Intelligence

Artificial intelligence is said to be in the heart of process automation, fraud detection, and financial planning based on what PwC reports on AI. In 2023, adopting artificial intelligence can be said to be valuable in terms of managing the risks of cyber attacks, for the supply chain maintenance and for increasing the efficiency of the financial sector to a level where there are no more any human interventions.

A branch of AI called NLP (Natural Language Processing), will be used across the digital banking sector in order to take care of the customer support wing by easily processing large volume of queries. Based on the report of Gartner, it is said that 25% of customer assistance and maintenance services will be taken care of by chatbots and/or virtual customer assistance by 2020. So if you are still thinking about implementing chatbot service in your business, it is time you think about it in a positive manner.

The Voice Technology

The number of users using Siri, Alexa, and Google Assistant is on a rise now and keeping this trend in mind, the banks of today are now getting a step ahead and implementing AI-driven voice technologies which can help them make the banking transactions secure and improve the customer experience of the call centers. In 2023, we will also get to see that a reliable mode of authenticating the bank account will be based on voice recognition technology. The added advantage of voice technology will be that it will let the customers to transfer money, make mortgage payments and review recurring balances.

Regulation Technology

FinTech is an industry which completely deals with money and so at any cost, it has to respect regulatory compliance and this is where the importance of Regulatory Technology comes in. It is capable to help financial businesses to cover both the model of risk management and compliance. Based on the predictions of Crowd Learning Hub, the investments in RegTech are expected to grow by 500% by 2021. Now this means an increase from $106 million to $53 billion over three years from 2017.

While delivering a speech on the development of RegTech and SupTech, the European Securities and Markets Authority stated that the rise in artificial intelligence and machine learning tools will make RegTech affordable. Machine Learning algorithms will help bankers and even banks to comply with the regulations which will be followed by examining and reporting the new ones. The penalties which are normally forced by GDPR can be bypassed easily in this manner.

Robotic Process Automation

RPA or Robotic Process Automation is here to eradicate human error and automate human efforts. It is said that by the end of 2021, 75% of financial service corporations will start using RPA software for their business. One of the main benefits of RPA is that even the people with no technical knowledge can start using it easily to follow workflows and the necessary processes can be built by non-developers.For the same reason, in 2023 we are bound to see technological advancements which makes use of workflow construction, bots and automation of employee duties.

Internet of Things

As per the predictions of PwC, more than 50 billion devices will be connected by 2021 and the revenue coming from IoT app development will exceed $3 trillion. When FinTech will have IoT integrated into it, the financial institutions and banking sector will be able to improve customer service and data protection while wearables can be used as a powerful tool for branding. You can even carry out digital payments using certain wearables.

The Cloud-based Approach

The “Cloud and Clear” report from Accenture, the modern banks of today need to change themselves and make use of cloud platforms for their software systems in order to comply with regulations and manage security. No doubt using cloud computing is not a new thing. Still, it has been found by Accenture that 43% of the banking institutions lack a proper cloud strategy and even fails to have a basic implementation. They may not be aware of the fact that moving your existing solution to cloud platforms or having a solution which is cloud-based can make the working of the organization more efficient and flexible. So for developing solutions, in 2023, FinTech providers should be focused on cloud-based approach.

Payment Services Directive 2.0

The PSD2 is legislation made in the EU, which lets you create a single market in order to integrate payment gateways as well as offer protection to customer data. It was in the year 2018 that PSD2 and GDPR came into effect both at the same time. And when it comes to sticking with PSD2, 2019 is considered as the most important year. A deadline has been announced as per which all the EU corporations are expected to comply with PSD2 regulatory Technical Standard by September 14 based on the directive (EU)2015/2366 (PSD2)

Initial Public Offerings

Initial Public Offerings which has managed to gain much of bad reputation will be seen taking new heights in 2023. Coinbase, Robinhood and Credit Carma are some of the big names in the industry which are trying their best to set up with IPOs in 2023. As more number of financial companies is cooperating with third parties, the (M&A) Mergers and Acquisitions deals are becoming more and more popular. Together, by trying to integrate blockchain, data analytics, and mobile wallets into the solutions they are trying to deliver an even better experience to the end users.

Biometric Technology

Biometric technology is widely used to offer enhanced security measures to clients. However, it is also used for quick authentication and verification for the accounts in order to help the users to log in easily and quickly as possible. In order to fight against cybercrime, the FinTech industry is trying to reduce fraud and risk and increasing security through prioritization.

Simplifying Procedures

The evolvement of the FinTech industry simplifies certain procedures too. This makes it easy for the businesses to cater to the needs of the customers in a better way all the while saving effort and time on different tasks. Instead of using cash, more and more customers are interested in using mobile payments and this has increased more with the existence of different mobile money transfer apps like PayPal, Square Cash and Venmo.

Apart from that, a number of mobile-friendly features like mobile wallets and QR codes, mobile deposits & number of IT based Banking & Finance solutions like cardless and digital payments and easy to use payment options are also available now. For example, today cardless ATMs are available where the customer can enter a numeric code and the pin of the card to carry out ATM services, can take a picture of a check to deposit it or even make use of smartphone camera to scan a code and get access to their money.

Digital Banks

Recently a new trend has been seen in the banking sector – the emergence of digital banks. These banks are completely digitized and there are no physical branches for it. The users can take care of their financial transactions by using their smartphones and mobile apps.

One of the examples of such a bank is Revolut. It can be used for instant payment notification, global money transfers and work as your account to spend globally for no fee. Another one you can have on the list is N26 which is again an idea of the digital bank which offers its clients the services for free when it comes to carrying out international transactions, lock their cards, set a limit for payments as well as send and receive instant notifications.

Wrapping it up

In 2020, the domain of FinTech will be seen implementing digital voice technologies, AI as well as cloud-based solutions. The kind of transactions that are carried out and compliance with cybersecurity will remain as the driving factors within the industry. The use of smartphones will no more keep mobile payments a thing of luxury. In short, for the finance sector, it is time they leave behind the traditional methods and turn to be digital. Here you either have the option to turn digital and get better or, lose your existing clients. If you are planning to implement the new technology, then for sure go through the FinTech trends 2023 for better clarity.

Looking for profitable

Fintech App for your Business