Executive Summary

A mid-market SEC-registered investment adviser modernized its data platform to deliver near real-time portfolio visibility and governed reporting. Using Fivetran for automated ingestion, dbt for modular transformations and semantic modeling, Snowflake for elastic warehousing, and Power BI for governed self-serve analytics, the firm consolidated APX, custodian, CRM, and finance data into trusted marts. The implementation cut quarterly reporting cycle time by half, reduced defects by over 90%, and improved compliance readiness, while lowering pipeline maintenance and improving adoption.

Business Challenges

- Fragmented data across Advent APX, custodian files, Salesforce, and finance systems caused reconciliation breaks and slow cycles.

- Manual, CSV-driven reporting required multiple analysts for weeks each quarter; compliance extracts took 5–7 business days.

- Limited transparency into data lineage, inconsistent KPIs, and low analyst trust in numbers.

- Need for near real-time positions/trades and governed access with book-of-business isolation.

Objectives

- Centralize and standardize data with minimal operational overhead.

- Deliver near real-time positions, trades, and cash with defined SLAs.

- Establish conformed dimensions, governed marts, and consistent KPIs for investment, operations, and compliance teams.

- Enforce robust security (RLS, masking), SSO, and full auditability.

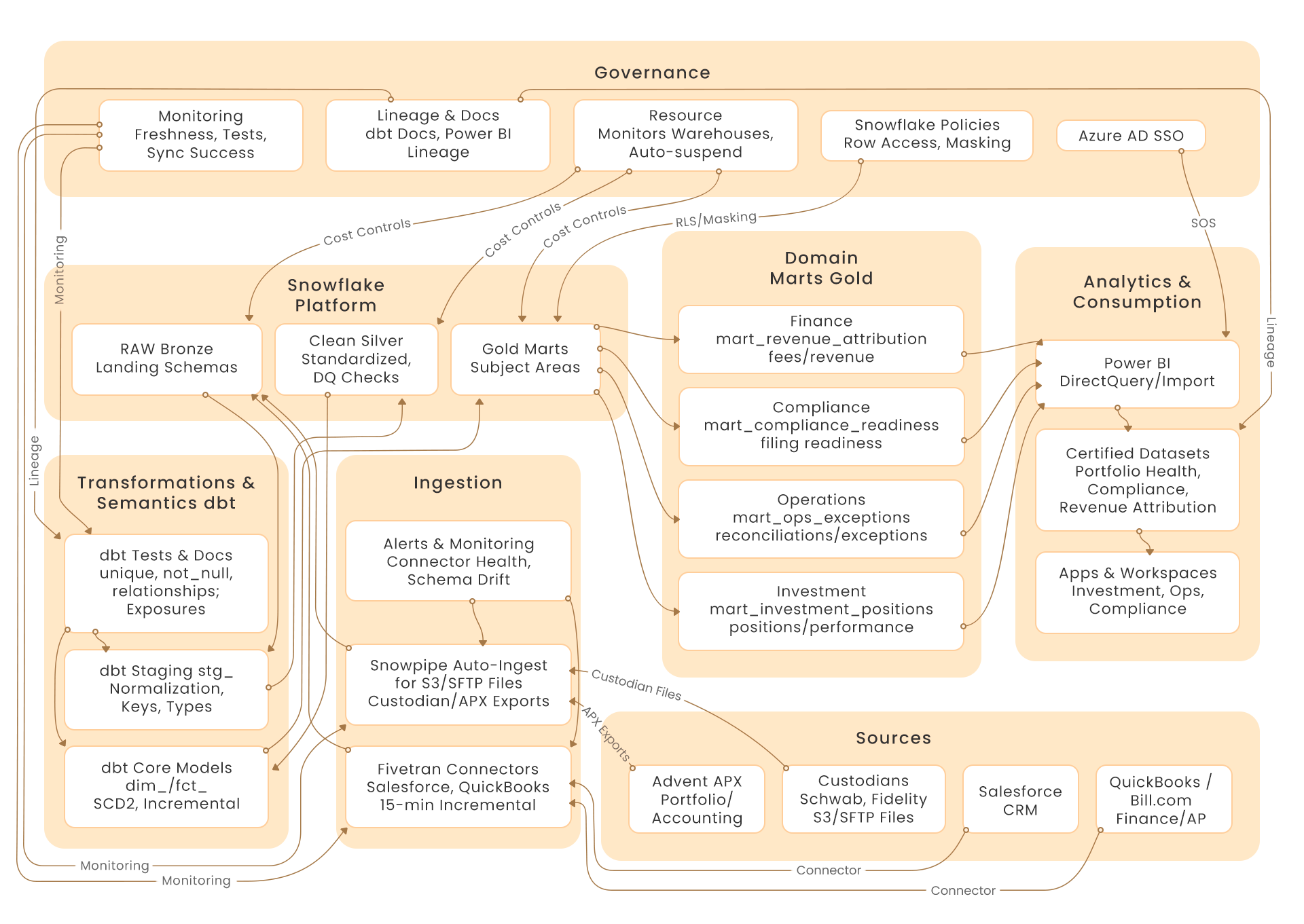

Solution Overview

We implemented a Snowflake-centered analytics platform with managed ingestion and modular modeling for reliable pipelines and governed, performant BI.

Data ingestion with Fivetran

- Prebuilt connectors load Salesforce and QuickBooks into Snowflake RAW schemas on automated, incremental schedules (typically every 15 minutes).

- Custodian and APX exports land via staged file ingestion (S3/SFTP) with Snowpipe Auto-Ingest for hourly updates and backfills.

- Connector health, sync logs, and alerts provide operational visibility; schema drift handled automatically.

Transformations and modeling with dbt

- A layered dbt project (stg_ → dim_/fct_ → mart_) conforms data, applies quality checks, and assembles a single source of truth for portfolio, performance, revenue, and compliance.

- Patterns include incremental models for trades/positions, SCD Type 2 for client-rep mappings, and conformed dimensions (dim_client, dim_account, dim_security).

- Data quality via dbt tests (unique, not_null, relationships, accepted_values) and schema contracts; exposures document lineage to Power BI assets.

Analytics and access with Power BI

- Power BI connects to Snowflake marts (DirectQuery for near real-time, Import where appropriate) to deliver Portfolio Health, Trade Exceptions, Compliance Monitoring, and Revenue Attribution.

- Certified datasets and governed app workspaces ensure consistent metrics and controlled distribution; row-level security is enforced in Snowflake.

- Deployment pipelines (Dev/Test/Prod) and endorsements streamline releases and adoption.

Architecture

Implementation Details

#1: Data Integration and Standardization

- Tools : Fivetran, Snowflake, dbt

- What we did :

- Configured Fivetran connectors for Salesforce and QuickBooks; raw data landed in RAW schema with source-specific naming.

- Automated custodian and APX file ingestion via S3/SFTP and Snowpipe Auto-Ingest; implemented historical backfills and hourly refresh.

- Built dbt staging models (stg_) to normalize instrument identifiers (CUSIP/ISIN), standardize timestamps/time zones, enforce types, deduplicate, and reconcile account-to-client mappings.

- Applied dbt tests and schema contracts upstream of marts to ensure reliability.

#2: Core Modeling and Subject Marts

- Tools : dbt, Snowflake

- What we did :

- Constructed conformed dimensions : dim_client (SCD2), dim_account (SCD2), dim_security; reference tables for custodians and advisors.

- Built fact layers for fct_trades, fct_positions_daily, fct_cash_movements, fct_performance_snapshots, and fct_revenue.

- Implemented business rules : trade_date ≤ settle_date, negative share checks, reasonability thresholds for accruals/fees, custodian vs APX reconciliation tolerances by asset class.

- Created Gold marts for Investment (positions/performance), Operations (exceptions/reconciliations), Compliance (regulatory extracts readiness), and Finance (revenue/fees).

#3: Security, Governance, and Cost Management

- Tools : Snowflake, Azure AD, Power BI

- What we did :

- Enforced Azure AD SSO, Snowflake masking policies for PII, and row access policies for book-of-business isolation.

- Established separate warehouses for ELT and BI; autosuspend (60s) and resource monitors to control spend; query tagging for chargeback and optimization.

- Published dbt docs for end-to-end lineage; Power BI lineage and endorsements for certified datasets.

#4: Orchestration and Operations

- Tools : dbt Cloud (or scheduled runs), Snowflake Tasks/Streams, Fivetran

- What we did :

- Scheduled incremental dbt runs aligned with Fivetran syncs and Snowpipe events.

- Used Snowflake Tasks and Streams to detect upstream changes and trigger downstream refreshes and exception checks.

- Monitored freshness, test pass rates, and sync success (>99.7%) with alerting to Slack/Email.

#5: Consumption and Decision Support

- Tools : Power BI

- What we did :

- Delivered domain apps :

- Investment : Portfolio Health (T+0 positions, drift >2% alerts, performance drilldowns)

- Operations : Trade Exceptions and Reconciliations (breaks by custodian/account, time-to-resolution)

- Compliance : Filing readiness, data completeness, pipeline health

- Finance : Revenue Attribution by product, client segment, and advisor

- Implemented certified datasets with clear owners, refresh SLAs, and RLS; enabled ad-hoc analysis on governed models.

Data Models and Tables (examples)

| Staging | stg_apx_tradesstg_apx_positionsstg_custodian_positionsstg_salesforce_accountsstg_quickbooks_invoices |

|---|---|

| Core | dim_client (SCD2)dim_account (SCD2)dim_securityfct_tradesfct_positions_dailyfct_cash_ movementsfct_revenue |

| Marts | mart_investment_positionsmart_performance_overviewmart_ops_exceptionsmart_compliance_readinessmart_revenue_attribution |

| Monitoring | met_data_freshnessmet_dbt_test_resultsmet_reconciliation_status |

Outcomes

Reporting and efficiency

- Quarterly reporting effort reduced from ~240 hours to ~112 hours across three cycles.

- Pipeline maintenance time reduced by ~62% after migrating to Fivetran + dbt.

Data quality and reliability

- QA defects per reporting cycle decreased from 13.2 to 1.0; dbt test pass rate improved to 98.8%.

- Sync success rate >99.7%; reconciliations surfaced and resolved earlier via exception dashboards.

Latency and performance

- Salesforce and QuickBooks data refresh every 15 minutes; custodian/APX files hourly; near real-time positions/trades where supported.

- Snowflake p95 query times under ~2.3 seconds on certified reports even as data volume scaled ~4.6x.

Adoption and satisfaction

- 55 monthly active Power BI users; 21 certified reports; 78% DAU within investment and operations.

- NPS improved from 46 to 51 post-launch; faster turnaround on data requests (SLA attainment up from 65% to 88%).

Compliance readiness

- All regulatory deadlines met for three consecutive quarters; complete audit trails and lineage simplified reviews.

Tech Stack

Snowflake

- Elastic compute isolation via virtual warehouses, separation of storage and compute, Time Travel, secure data sharing, and robust governance features.

Fivetran

- Managed connectors and scheduling reduce pipeline maintenance; predictable costs with MAR-based pricing.

dbt

- Transformation-as-code with built-in testing, documentation, and CI/CD for reliable analytics engineering.

Power BI

- Widely adopted enterprise BI with strong governance and security, ideal for executive and operational reporting.

Implementation Timeline

Weeks 0–2

- Discovery, source profiling, data contracts, KPI definitions

Weeks 3–6

- Fivetran connectors, Snowpipe for files, RAW landing (Bronze)

Weeks 7–10

- dbt STG/CORE (Silver), initial marts (Gold) for positions/trades/performance

Weeks 11–14

- Certified Power BI datasets, RLS, workspace governance, deployment pipelines

Weeks 15–18

- UAT, performance tuning, training, rollout; iterative dashboard expansion thereafter

Representative KPI Examples

- Reporting cycle time : 240h → 112h

- Defects per cycle : 13.2 → 1.0

- Data request SLA attainment : 65% → 88%

- Sync success : >99.7%

- p95 query time on certified reports : <2.3s

Testimonial

Our quarterly statements now close in days, not weeks—and the investment team trusts the numbers. We gained real-time visibility without adding maintenance overhead.

- COO

Team Composition

- Project Manager: 1

- Data Architects: 2

- ETL Developers: 2

- Database Administrator: 1

- BI Developer: 1

- Quality Assurance Specialist: 1

- Support Staff: 1